The probability of recession arising, and inflation re-accelerating have both being revised up, discussed in full within our economic update. This quarter we also take a walk down memory lane, looking at similarities to 1948 and offer up some killer dinner party conversation fodder... the 'kinked Phillips curve' framework, in our deep dive into labour markets.

The final quarter of 2023 saw markets firm on a soft landing outcome, with a rally in equities and a pricing of interest rate cuts in 2024. Disinflationary forces have seen Central Banks make remarkable progress in returning inflation back towards target. Might this be the goldilocks outcome Central Bankers hoped for and #markets thought impossible just 12 months ago?

This Quarterly discusses the two competing economic scenarios and the key data points that help inform our views on the outlook for 2024. We finish off with a run down on investment positioning, pockets of potential value and our favourite graph from 2023.

With markets beholden to interest rates, we answer the two biggest questions investors should be asking. How long will interest rates remain low, and what are the consequences of low rates.

This quarterly update is a seven-minute overview of the economic landscape and how we think about investing in a low rate environment.

Please feel free to forward this summary to clients, colleagues and friends who can in turn subscribe.

Our quarterly snapshot of key economic, investment and sector themes. Three stock to watch and a BREXIT special update. We also look at two of Snowgum's latest policy submissions.

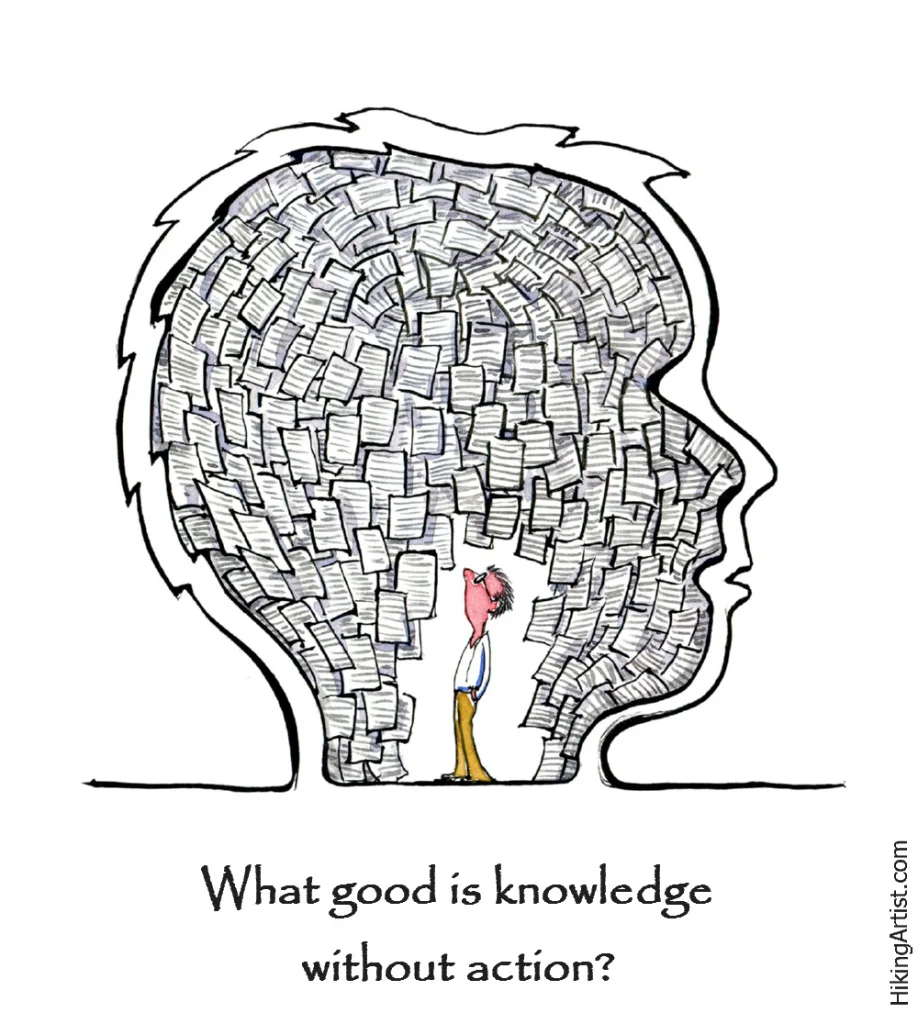

Turning your business into a success is only half the battle. Failing to make the most of the value and wealth your business generates, completely undermines the blood, sweat and tears required to extract value from your business.

Is there a simpler way to cut through investment noise?

The merits of ethical investing and the wonders of debt recycling

The nuts and bolts of investing in three minutes